Requiem for the American Dream (2015)

"Through interviews filmed over four years, Chomsky unpacks the principles that have brought us to the crossroads of historically unprecedented inequality - tracing a half century of policies designed to favor the most wealthy at the expense of the majority."

---

background:

American democracy was historically only allowed voting for property owning (white) men.

"If Athens were a democracy for free men, the poor would get together and take away the property of the rich. Aristotle proposed what we would now call a welfare state: he said try to reduce inequality. So same problem, opposite solutions: one is reduce inequality you won't have this problem and the other is reduced democracy."

In the 1960s, 70s there was a strong push for democracy and equality, with Black rights, women's rights, environmental policy, protest against Vietnam war. A growing middle class, and particularly young people, speaking out for the people's concerns was dangerous to the corporate elite.

---

The corporate response was to take away democracy from the people in the following way:

Privatize Higher Education to control the young people

and ship manufacturing jobs overseas to manipulate the economy.

What this accomplishes is: 1) depoliticize young people, 2) lower wages of the production costs, 3) increase worker insecurity.

---

Corporations don't want voters exercising their democratic power to push issues that matter to them. this activism was in large part coming from students. 'There's a failure on the part of schools, the universities and churches - the institutions responsible for the indoctrination of the young.' What they've done is privatize the education system, the centers of thought, and use the debt of education costs to keep young people from acting out. and consequently depoliticize the general population.

"More than half the states, most of the funding comes from the tuition not from the state. That's a radical change. And that's a terrible burden on students. It means that students, if they don't come from very wealthy families, they're going to leave college with big debts. And if you have a big debt, you're trapped. I mean, maybe you wanted to become a public interest lawyer. But you're going to have to go into a corporate law firm to pay off those debts. And by the time you're part of the culture, you know, you're not going to get out of it again. And that's true across the board."

Reduce the production economy at home. Off-shoring of production. "The trade system was reconstructed with a very explicit design of putting working people in competition with one another all over the world. And what it's led to is a reduction in the share of income on the part of working people."

Overseas jobs hurts production workers everywhere, including the ones at home, and favors the already rich. "An American worker is in competition with a super-exploited worker in China. Meanwhile highly paid professionals are protected. They are not placed in competition with the rest of the world."

Comment: If you keep production at home, your consumers are also your producers, so you have to pay the lowest worker (the guy who made the thing) a living wage and enough surplus to buy your products. On the other hand, if you have an overseas worker, he is not your consumer market and it doesn't matter what you pay him.

Keep the working class jobs insecure. They won't be brave enough to ask for better wages, working conditions, or demand to unionize. You can pay them less benefits by keeping the staff part-time, and let them work two or three jobs.

"Allan Greenspan, when he testified to Congress [1997 testimony], he explained his success in running the economy as what he called greater worker insecurity."

The performance of the U.S. economy over the past year has been quite favorable. Real GDP growth picked up to more than three percent over the four quarters of 1996, as the economy progressed through its sixth year of expansion. Employers added more than two-and-a-half million workers to their payrolls in 1996, and the unemployment rate fell further. Nominal wages and salaries have increased faster than prices, meaning workers have gained ground in real terms, reflecting the benefits of rising productivity.Comment: shifting the economy from production to financial services in tandem with controlling higher education allows you to increase the level of worker insecurity. because higher paying financial jobs require your employees to reach a higher level of education. so you control the institutions of higher learning, you force young people wanting to enter the workforce to take on debt to 'get a good job (#1 priority for the Daddy helping pay the tuition)' the pressure of student loan payments will force students into taking any job available.

...

In 1991, at the bottom of the recession, a survey of workers at large firms by International Survey Research Corporation indicated that 25 percent feared being laid off. In 1996, despite the sharply lower unemployment rate and the tighter labor market, the same survey organization found that 46 percent were fearful of a job layoff.

...

Thus, the willingness of workers in recent years to trade off smaller increases in wages for greater job security seems to be reasonably well documented. The unanswered question is why this insecurity persisted even as the labor market, by all objective measures, tightened considerably. One possibility may lie in the rapid evolution of technologies in use in the work place.

...

No longer can one expect to obtain all of one's lifetime job skills with a high-school or college diploma. Indeed, continuing education is perceived to be increasingly necessary to retain a job.

...

Certainly, other factors have contributed to the softness in compensation growth in the past few years. The sharp deceleration in health care costs, of course, is cited frequently. Another is the heightened pressure on firms and their workers in industries that compete internationally. Domestic deregulation has had similar effects on the intensity of competitive forces in some industries. In any event, although I do not doubt that all these factors are relevant, I would be surprised if they were nearly as important as job insecurity.

The real value of higher education is not for the student to get a good job, but for corporations to increase his or her debt. Let all the young people graduate with degrees, even if the job market is already flooded, that way they compete with each other, so they have no job security, and even if - no, especially if they can't pay out of pocket for tuition - give them loans! so they have a pressing debt that forces them to accept lower salaries.

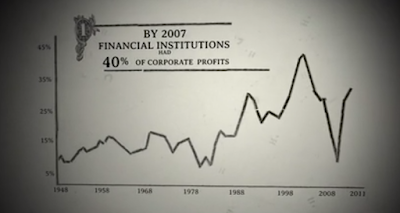

Move to a financial economy.

GE "makes half its profits just by moving money around in complicated ways. and its very unclear that they're doing anything that's of value to the economy"

---

Comments: Investments, banking, loans, stock trading. All ways of funneling money toward the top, without having to manufacture any physical product or render any physical service with inherent value. In other words, it's a system of taking money from people without really giving back anything in return.

What it is - is like gambling with other rich people, betting on the portion of the economy that are doing something useful: producing or providing a necessity service. If my workhorse wins the race, you pay me double what I tossed in the pot. But when the financial economy gets too big, there are only so many winning workhorses to pay profits... so the betting gets riskier and more vulnerable to a huge gambling loss.

Too many risky investments, then the banks fail and the government has to move in to recoup their losses. In other words, the very workhorses the rich were betting on, they have to pay their masters when they lose the race. The rich win either way.

---

"Each time the taxpayer is called on to bail out those who created the crisis. Increasingly, the major financial institutions. In a capitalist economy you wouldn't do that. In a capitalist system that would wipe out the investors who made risky investments. But the rich and powerful, they don't want a capitalist system. They want to be able to run to the nanny state, as soon as they are in trouble and get bailed out by the taxpayer. That's called too big to fail."

"For the poor, let market principles prevail. Don't expect any help from the government. The government is the problem, no the solution."

"One set of rules for the rich. The opposite set of rules for the poor."

No comments:

Post a Comment

You can add Images, Colored Text and more to your comment.

See instructions at http://macrolayer.blogspot.com..